We don’t just sell chargers—we make your station run

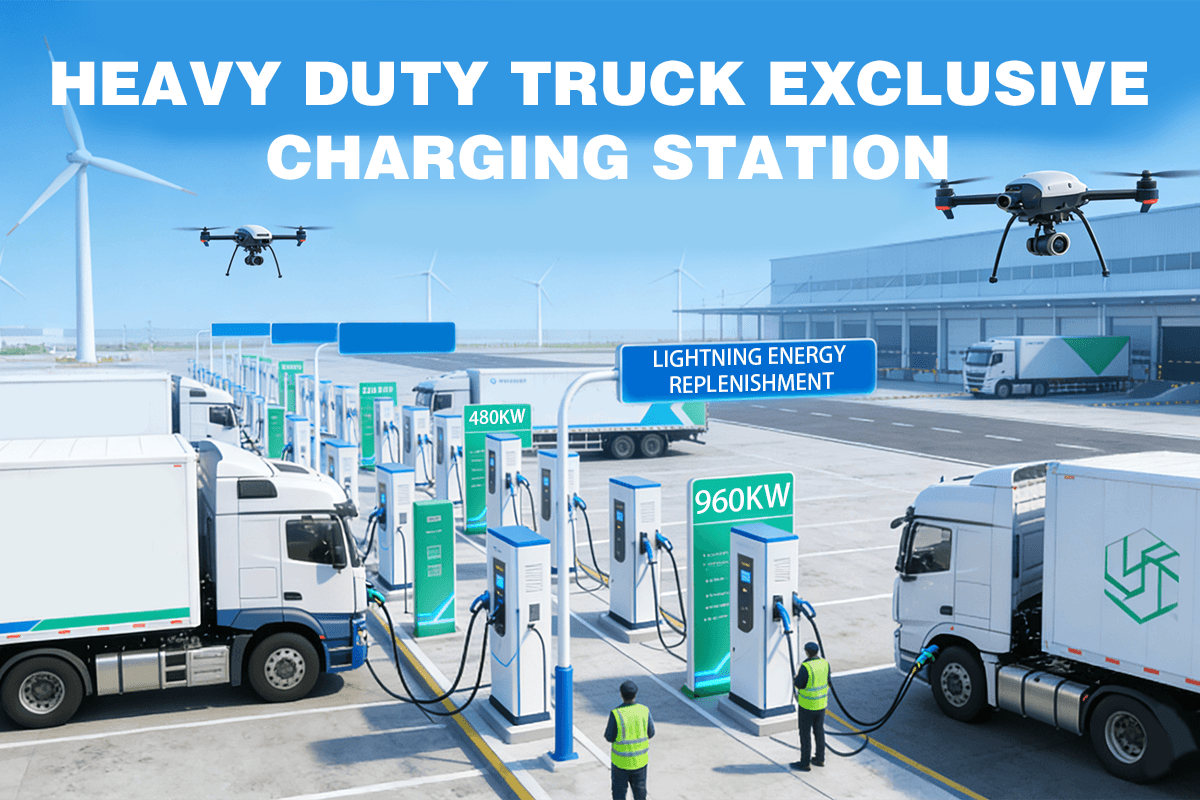

A one-stop rollout plan for logistics-park DC charging built around dual-gun posts (180–240 kW as the main tier, 320–480 kW as peak-shaving)

Scenario (typical for many parks)

• Fleet mix: mainly 400 V heavy/medium trucks, with 800 V models gradually joining.

• Rhythm: two daily peaks, 05:30–08:30 and 17:00–21:00.

• Business goal: ≥40 vehicles per hour from 25% → 70% SOC, with ≤10 min queue time.

• Budget view: plan on 3–5-year TCO, targeting cash-flow control in year 1 and stable returns by year 3.

>Note: In many countries, approvals, civils/fire rules, cable routing, cross-brand compatibility, and after-sales boundaries make centralized “power-cabinet + many dispensers” systems hard to deploy and troubleshoot. We therefore recommend a distributed layout using dual-gun DC posts as the core. Deployment and operations checklists for non-technical teams: U.S. DOE AFDC AFDC (https://afdc.energy.gov/)

1) Sizing principle: 80% steady, 20% sprint

• Main tier (70–80% of bays): dual-gun 180–240 kW (air-cooled). This aligns with most 400 V vehicles’ real accepted power (~90–130 kW between 20–60% SOC), giving high throughput, simpler maintenance, and lower thermal derating risk.

• Peak-shaving tier (20–30% of bays): dual-gun 320–480 kW (liquid-cooled 500–600 A). Reserved for 800–1000 V models, urgent jobs/short dwell, and hot seasons—“in fast, out fast”—and also serves as a high-power “hero bay”.

Why not make 320–480 kW the main tier? Because the vehicle BMS is the real ceiling. Air-cooled cables are commonly 300 A; even at 800 V that’s ~240 kW. Sustained power above this typically requires liquid cooling, which raises CapEx/Opex and thermal sensitivity and makes you more exposed to demand-charge spikes. AFDC has plain-English primers on tariffs and demand charges: https://afdc.energy.gov/ (https://afdc.energy.gov/)

2) The offer in one view: equipment + architecture + backend = one package

Site configuration (example, adjustable to your data):

• Hardware: 12× dual-gun 180–240 kW (air-cooled) — main bays (=24 guns)

• Hardware: 4× dual-gun 320–480 kW (liquid-cooled) — peak bays (=8 guns)

• Total: 32 guns, sized to the “≥40 vehicles/hour” target (quick math below)

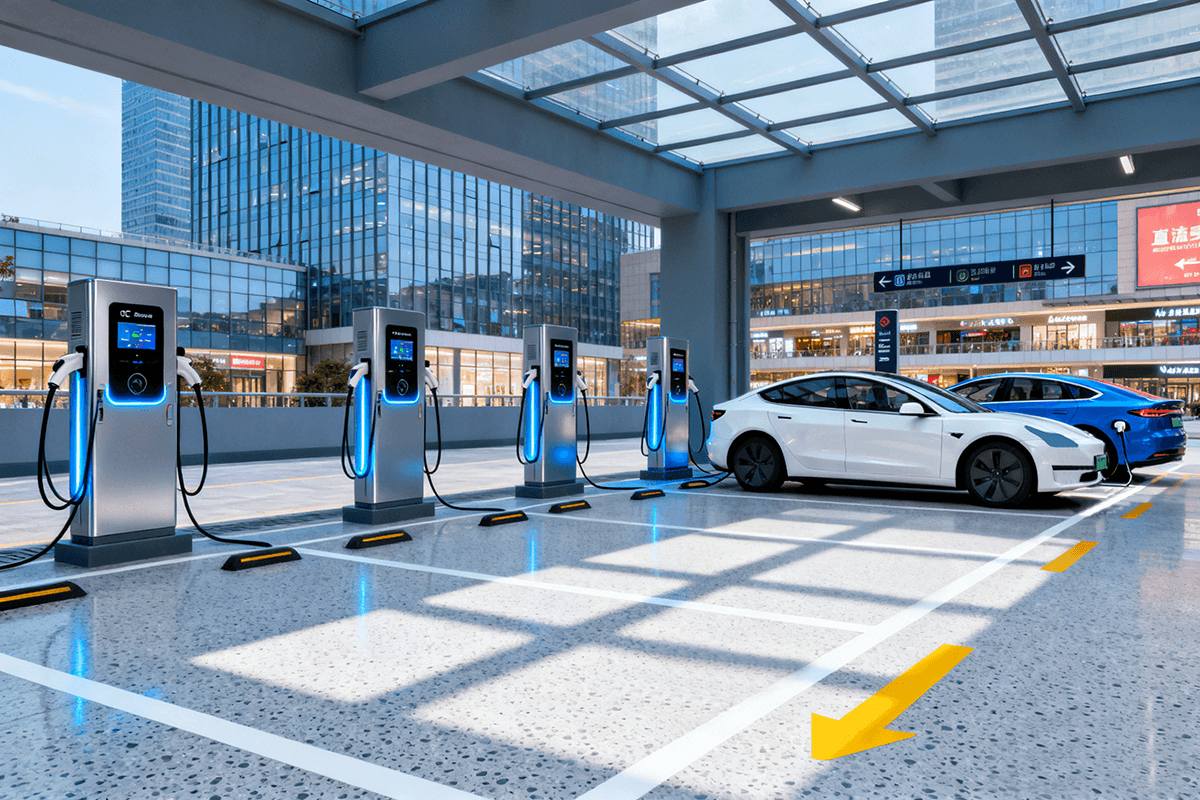

• Interfaces & customization: CCS2/GB/T (mix a few CCS1 if needed), branding/HMI languages, wayfinding/signage.

• Layout & civils: Drive-through, overhead booms/retractors, shading, pedestrian/vehicle separation, maintenance aisles and lifting access.

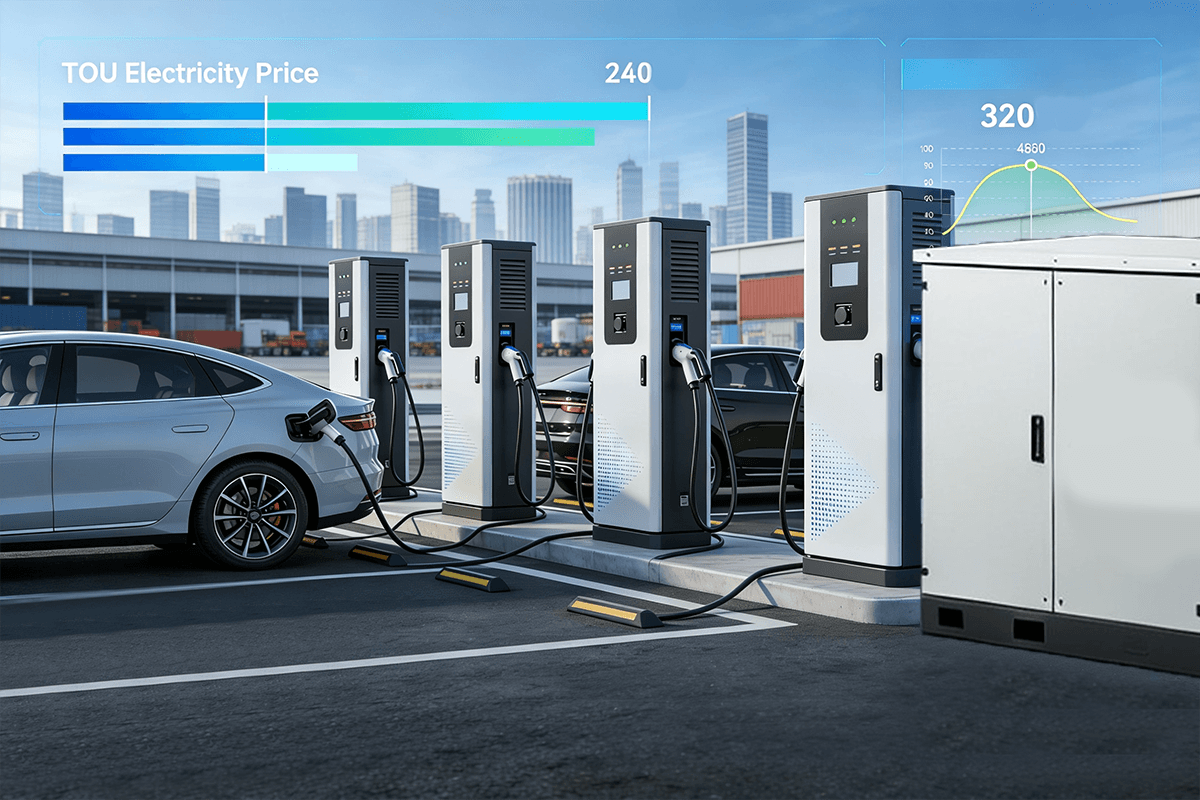

• Backend: OCPP 1.6J connection (open, interoperable) with booking/time-of-use, member/plate/card billing; remote ops, alerts, and reporting (OCA on OCPP: OCPP 1.6 official page (https://www.openchargealliance.org/protocols/ocpp-16/)).

• Peak shaving & tariffs: optional 200–400 kWh ESS to clip peaks and recharge off-peak, reducing demand charges and transformer stress (AFDC deployment & tariff checklists: AFDC (https://afdc.energy.gov/)).

Services & backend support:

• Pre-go-live: one-line diagrams & short-circuit study, fire/shade/wayfinding, tender specs, SOPs, and emergency drills.

• Go-live week: remote dashboards, alert thresholds, KPI fields (availability, avg. wait, derating events, revenue/kWh, demand charges).

• 90-day review: tune utilization × pricing (see McKinsey public DCFC examples showing ~15% utilization and $0.45–0.53/kWh price bands near break-even in some markets). Use booking + TOU to shift queues from peak to shoulder (AFDC deployment pages).

• Annual upgrades: add a few liquid-cooled bays as your fleet shifts; if megawatt-class trucks appear, scale per local code (follow CharIN MCS roadmap: https://www.charin.global/technology/mcs/ (https://www.charin.global/technology/mcs/)).

NREL recommends sizing from vehicle needs and duty cycles; see EVI-X and related guides: https://www.nrel.gov/transportation/fleet-electrification.html (https://www.nrel.gov/transportation/fleet-electrification.html)

3) Quick back-of-the-envelope (swap in your own numbers)

Target: ≥40 vehicles/hour, each from 25% → 70% SOC

Assume truck battery ≈280 kWh (replace with your actual average)

• Energy per vehicle: 0.45 × 280 ≈ 126 kWh

• With real charging power averaging 160 kW (considering BMS curve/thermal):

– Time/vehicle ≈ 126 / 160 ≈ 47 min

– Concurrent guns ≈ 40 × 126 / 160 / 1 h ≈ 31.5 guns

→ Example mix: 24 guns (180–240 kW) + 8 guns (320–480 kW) = 32 guns meets the target: main bays carry steady throughput; high-power bays kill peaks.

4) Why this mix is lower-risk, easier to maintain, and better on the math

1) Matches the vehicle ceiling: Most 400 V trucks accept ~90–130 kW between 20–60% SOC. A 180–240 kW main tier runs efficiently and thermally stable.

2) Availability & queues: More medium-power guns running in parallel cut queues—drivers feel it.

3) Tariff control: Fewer sustained 480 kW bursts means fewer demand-charge spikes. ESS + TOU flattens the curve (AFDC primers: https://afdc.energy.gov/ (https://afdc.energy.gov/)).

4) Clear maintenance boundaries: With distributed dual-gun posts, a fault is localized; spares and troubleshooting are simpler and more predictable across countries.

5) Open ecosystem, future-proof: OCPP keeps you interoperable for platform partners and future swaps (OCA: OCPP 1.6 (https://www.openchargealliance.org/protocols/ocpp-16/)).

5) Milestones & deliverables

• T-0 to T-30 | Feasibility & plan: vehicle/curve modeling, concurrency target, layout & civils, budget & timeline.

• T-31 to T-75 | Build & integration: install dual-gun posts, power/comms, OCPP/billing/booking integration, shade & booms.

• T-76 to T-90 | Trial ops: KPI thresholds, ticket/alert flow, SOP rollout, training, month-one report & tuning.

• T-91+ | Steady state: monthly reviews (utilization/wait/derating/revenue/kWh/demand charges/ESS contribution), annual ROI check and expansion plan.

Methods & tools: NREL fleet/network and site-sizing resources, plus AFDC deployment and procurement checklists: NREL Fleet Electrification (https://www.nrel.gov/transportation/fleet-electrification.html) · AFDC (https://afdc.energy.gov/)

6) References & further reading (easy for newcomers)

• DOE / AFDC — Infrastructure deployment & demand-charge primers (tariffs, checklists, ops basics): https://afdc.energy.gov/

• Open Charge Alliance — OCPP 1.6 (open, interoperable charger-to-backend communication):https://www.openchargealliance.org/protocols/ocpp-16/

• NREL — Fleet electrification & site planning (size from vehicle needs and duty cycles):https://www.nrel.gov/transportation/fleet-electrification.html

• CharIN — MCS roadmap (for future heavy-truck megawatt charging):https://www.charin.global/technology/mcs/

• McKinsey — Public DCFC economics and utilization/pricing sensitivity (see e-mobility article set for regional examples).

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.